Last week, I attended the Yacht Cub de Monaco: Capital of Yachting Experience. It was a very well organised and attended event, with some very interesting presentations and discussions.

It was also the launch of the Yacht Club de Monaco Superyacht Eco Association (SEA) INDEX. Supported by Nobiskrug and Credit Suisse, this is an important initiative with a goal to benchmark yachts in terms of their CO2 environmental performance. And, whilst there are other emissions, CO2 is by far the largest greenhouse gas (GHG) of importance and the one most visible in the public eye.

The principle is that it uses the IMO’s Energy Efficiency Design Index (EEDI) formula with a few changes to make it more specific to yachts.

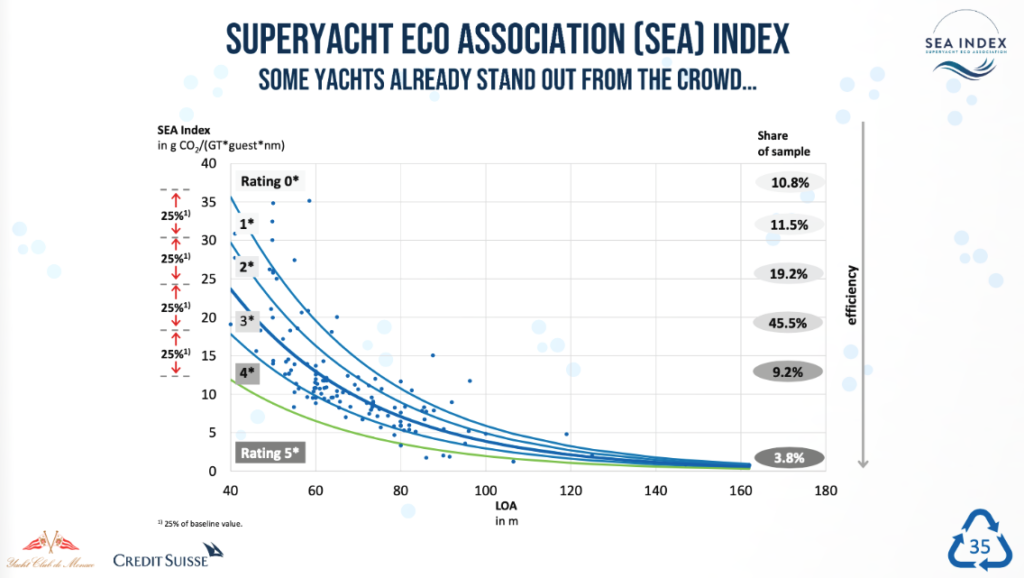

The SEA INDEX is the first tool designed to assess and compare the efficiency of a yachts design and its environmental impact in terms of CO2, with a transparent and easy to understand rating system. Stars are awarded from 1 (lowest rating) to 5 (highest rating) depending on where a yacht sits above or below the rating bands relative to the baseline of sampled yachts.

Image: Courtesy of the SEA INDEX

The data from approx. 130 yachts of various length and displacement was sampled and their data entered in order to develop the initial baseline – there are now over 200 yachts.

It uses max power and speed, which may seem excessive, but a metric was required and, if you consider this as the ‘maximum emissions potential’ of a yacht, by using the same set of data points for all yachts, it provides a ‘standard’ for comparing their designs. For example, on comparable sized yachts, a more efficient hull will require less power for the same speed, and more efficient HVAC and hotel systems power management, will require smaller generators, both of which will result in reduced emissions and a higher INDEX rating.

And, as new designs and engineering innovations are introduced into yachting, the SEA INDEX will help highlight the improvements being made.

Of course, actual emissions depend on many variables that are affected by an owner and the operational profile of a yacht – these are hard to assess in any consistent or meaningful way. If we had recorded all yacht activity and consumption over the last 10 or 20 years, we would be able to draw a curve of standard deviation and have an idea of what might be described as ‘average use’ on which to make comparisons. Unfortunately, we don’t have this information, and this is perhaps the flaw in all such tools, so the only true account of a yachts CO2 emissions has to be calculated from their fuel consumed.

The factor the IMO use for CO2 emissions from MGO is 3.206, this means for every 1,000t of MGO used, 3,206t of CO2 is generated so it is easy to calculate your CO2 from fuel.

Any design efficiency gains, and improvements that can be made in the operation of the yacht, such as running at lower speed, managing power, switching off unused lighting and equipment, etc., will reduce the power required, fuel consumed and emissions.

In combination with efficiency gains, Carbon offsetting is one way to mitigate a yachts emission. Though, as I have written in a previous piece Superyacht Carbon Offsetting great care is required to select one that is fit for purpose.

But, it’s not just the amount of CO2 that is an important consideration. Looking to the future, it is very likely that shipping, like other industries, will be impacted by Market Based Mechanism’s (MBM) to drive forward the transition to a greener future, and these will have cost implications.

The IMO by 2023 will introduce their new framework for the reduction of GHG emissions from shipping and it could include a carbon tax. The EU in a recent plenary session of parliament, agreed that shipping should be included in the EU Emissions Trading Scheme (ETS) possibly in 2021and include vessels less than 5000gt. Trafigura, one of the World’s largest ship charterers, published on 25th September “A proposal for an IMO-led global shipping industry decarbonisation programme” calling for a $100 – $200 tax per ton of CO2 on shipping as the only way of driving the necessary industry change.

As further evidence of the direction of travel for CO2 emissions for business, Swiss Re made this announcement on the 15th September 2020:

“Swiss Re steps up its internal carbon levy to USD 100 per tonne as of 2021 and will gradually increase it to USD 200 per tonne by 2030”

Any such taxes or levies imposed on CO2 emissions will increase the cost of yacht ownership.

On top of that we have Environmental Governance and Sustainability (EGS) targets that are becoming ever more prevalent, especially in investment and finance. The Poseidon Principles is just one initiative, launched the 18th June 2019, “major shipping banks will for the first time integrate climate considerations into lending decisions to incentivize maritime shipping’s decarbonization” their goal is to work towards the IMO 2030 and 2050 reductions in GHG by ensuring that their loan books are aligned with those targets – finance will become harder for vessels that fail to meet efficiency improvements and GHG reductions.

Could similar lending rules apply to yachts in the future, how would that affect the value of older less efficient yachts?

Whilst it is not yet clear how taxes and regulations will be imposed in the future, what is clear, is that yachting is unlikely to escape their embrace. And our intimate connection to the sea and the environment places additional responsibility on the industry to protect the health of our oceans and planet. The SEA INDEX is the first of many important tools, including those from the Water Revolution Foundation, that will help us to understand our environmental footprint and drive the necessary change that puts us on a pathway to a sustainable superyacht industry.

Like any instrument that is reliant on data; the more yachts that participate, the more refined and accurate the SEA INDEX will become – I would call upon all Captains to get involved.

More information, including the Free calculator, can be found here https://superyachtecoindex.com/