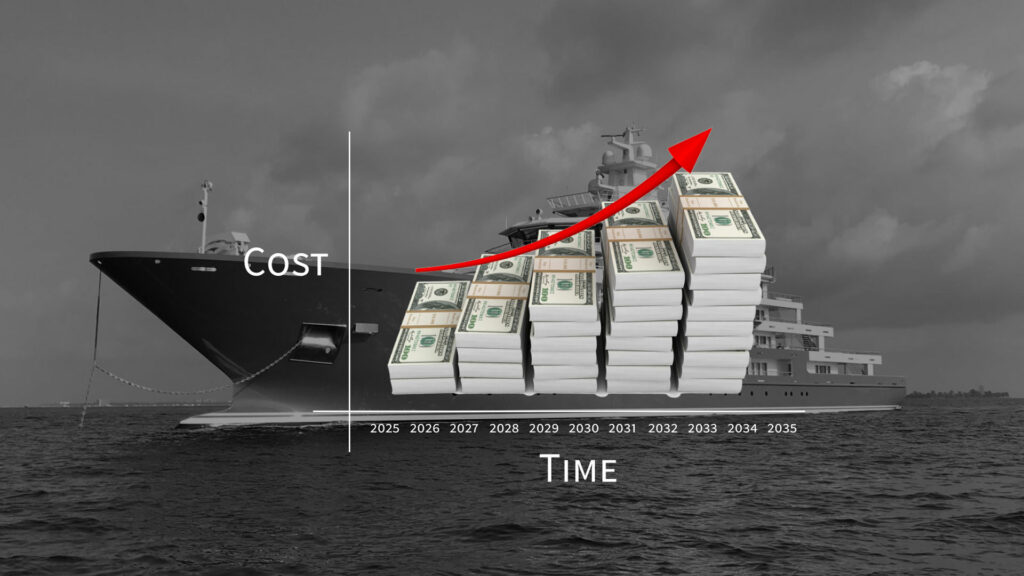

Superyacht ownership will be more expensive in the coming years. This is not only due to inflationary pressures e.g. raw materials, employment, and the cost of finance, but also factors driven by climate change. These will affect: –

- Operational Costs

- Build Cost

- Finance

- Resale

In a series of articles superyacht2030 will consider their impact on the cost of superyacht ownership.

Part I will look at Operational Costs, principally a carbon tax as this has the potential to have the biggest impact on cost and incentive to transition to more energy efficient yachts, alternative technologies and fuels.

A $100 carbon tax could add over €300,000 to the annual fuel bill of a two season 65m+ yacht.

Current Situation

Most superyachts and passenger yachts, due to vessel type and size, are excluded from the IMO EEDI/EEXI, upcoming Carbon Intensity Indicator and Reporting, and the EU Carbon Tax on Shipping.

There is little to drive energy efficiency or to prevent the building of high performance, gas guzzling superyachts. Owners can build whatever they want and, shipyards, even those who are vocal about sustainable yachting, will build them – that’s their business!

This will no doubt change as it is impossible to imagine that the superyacht industry can remain untouched by externalities that are driving decarbonisation throughout the rest of business and industry. These include regulation, tax and societal pressure.

The next IMO GHG Strategy due in 2023 may provide some clarity on regulations. It will certainly need to be more ambitious than their current strategy if shipping is going to achieve net-zero by 2050. And, it may finally include a market-based mechanism (MBM) such as carbon tax which many in the industry are calling for.

The EU have already taking the lead on this with plans to include shipping in their Emissions Trading System (ETS) in 2023.

The Marshall Islands, one of the largest ship registries, along with the Solomon Islands, have submitted to the IMO a proposal for a $100.00 carbon levy on all shipping, with an annual, or five yearly, 30% or 100% increase, effective 2025 at the latest.

Maersk, one of the largest shipping companies, has called for a $150.00 levy on shipping to accelerate the transition to low carbon fuels.

Operational Costs

Energy; diesel fuel and shore-power, is one of the high operational costs.

The energy costs are dependent on a yachts energy efficiency. This is not just main engines and generators, it also requires improvement and optimisation of every system and design element. Many of the solutions are already here, it just takes a willingness to accept the ‘green premium’.

There are alternative fuels that will lower CO2 emissions such as renewable diesel, bio-methanol, e-methanol or hydrogen, but they will be 2 – 4 times more expensive than diesel fuel – the ‘green premium’. As production scales up the price should come down, the cost of feedstock, production process and competing demands from other sectors, will keep prices high in the medium term.

Diesel fuel will not shield an owner from higher costs – cheap ‘carbon offsets’ will not help either!

Carbon Tax

The EU carbon tax on shipping will initially apply to vessels 5000 GT and above in EU waters (a cross boarder mechanism will also prevent ‘slippage’). The IMO, and other governments, will very likely follow suit with their own more far reaching plans as the urgency to reduce GHG emissions grows.

The EU plan to use a well-to-wake (WTW) CO2 factor for all fuels i.e. ‘upstream’ and ‘use’ emissions. WTW is a more robust method for measuring net GHG emissions as the feedstock and production processes are also included. Current IMO tank-to-wake (TTW) factor is 3.206 tCO2/tMGO, and the EU WTW factor is approx. 3.8 tCO2/tMGO.

Although the Marshall Islands have proposed a starting price of $100 tCO2 by 2025, the current price of a EU ETS Carbon Credit is now over €80.00 t/CO2. Competing demands are expected to raise prices – it has gone from €30.00 tCO2 to over €80.00 tCO2 in the last 12 months alone. It could quite easily be more than €200.00 t/CO2 by 2030 – that would add €780.00 to every ton of MGO!

Therefore, with the high price of alternative fuels and a carbon tax, energy efficiency will be a critical factor in the total cost of ownership (TCO).

A more energy efficient yacht could help save €millions in operational costs.

The calculator below highlights the effect of a carbon tax on fuel cost, and the cumulative savings of a more energy efficient yacht.

FUEL, CARBON TAX, EFFICIENCY CALCULATOR

Notes:

- Assumes 2025 as the start date for a carbon tax

- Uses EU WTW factor, approx. 3.8 tCO2/tMGO

As one of the most effective methods for driving down carbon emissions, there is a certain inevitability that a carbon tax will eventually affect the wider maritime industry, including superyachts. We don’t know when, buts it risk that needs to be considered.

While we know that not all owners are motivated to improve their yachts environmental impact, and others may struggle to justify the cost benefit/return on investment (ROI) of hybrid or other technology solutions, a carbon tax would have a significant impact on TCO.

It would certainly focus the mind on buying and building only the most energy efficient superyachts!

More to follow in Part II…

Don't forget to subscribe to be first to receive the latest insight!